NEWS & INSIGHTS

Brokers dominate mortgage market as banks try to win back share

Mortgage brokers are settling more home loans than ever. They now account for almost 77% of new residential loans, putting them on track to originate more than $400 billion in loans in calendar year 2025.

With the bulk of new lending now going through brokers, are banks at risk of losing their once-coveted direct relationship with Australian borrowers?

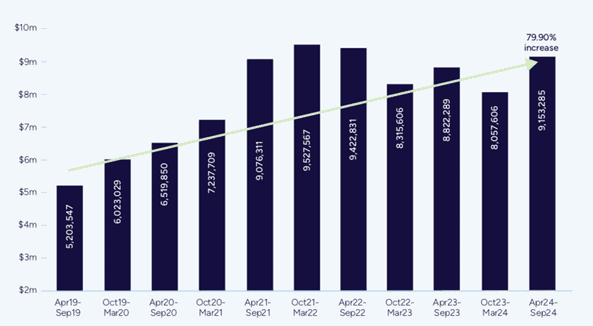

According to a recent report from the Mortgage and Finance Association of Australia (MFAA), mortgage brokers wrote $378.9 billion in new home loans in the year to September 2024, the highest value on record. In the six months to September 2024, they settled $203.8 billion, up by more than 16% on the previous period.

Figure 1: Value of home loans settled by brokers, by six-month period

Source: MFAA, Industry Intelligence Service, 19th edition

Over that six-month period, the average loan settlement per broker rose in tandem to $9.2 million from $8.1 million in the previous six months. The number of brokers grew too, expanding by 12% to reach 22,265 by late last year.

Figure 2: National average value of home loans settled per broker

Source: MFAA, Industry Intelligence Service, 19th edition

“We’re seeing this strong and growing consumer preference for the choice, convenience and competitive offerings that brokers provide,” says David Bailey, CEO of aggregator AFG.

Trust and repeat business drive growth

Trust has played a big part in the channel’s growth. The ‘best interests duty’ introduced by the Australian Government in 2021 requires brokers to act in their customers’ best interests. This regulation has helped build consumer confidence and drive repeat business.

Brokers also benefit from strong word of mouth.

“More and more customers are coming into the broker channel, and as they transact again, they are more likely to come back to a broker and refer their friends,” says David Hyman, CEO of mortgage broking firm Lendi.

More brokers going into commercial lending

More mortgage brokers are also embracing commercial lending to broaden their customer base and revenue opportunities. The number writing commercial loans rose by 24% to 7,023 in the six months to September 2024.

This increase contributed to a more than 30% rise in the value of commercial loans settled by brokers, reaching $22.7 billion over the same period.

Investment bank Barrenjoey estimates that brokers are now responsible for 30% of commercial loans written by banks. For neobanks and non-bank lenders, the figure is typically much higher.

MFAA CEO Anja Pannek says diversifying into commercial loans boosts competition and choice. “Borrowers know brokers have the skills to find the right financial solutions for them and increasingly we can see that extends to commercial loans,” she adds.

Banks feel the cost pressure

But this growing competition is making life harder for the major banks.

Commonwealth Bank’s 2H 2024 results show that home loans written through brokers were 20% to 30% less profitable for the bank than loans sourced through in-house distribution.

Brokers are simply more expensive for banks. They typically receive upfront payments of 65 basis points and a trailing commission, creating about $4 billion in gross annual revenue for the channel, according to investment bank Jarden.

Banks have started to respond. National Australia Bank and Westpac have flagged plans to focus more on direct lending through branches and contact centres, while Commonwealth Bank removed its caps on bonuses to keep staff from moving to the broker channel.

Borrowers still backing brokers

However, industry watchers are sceptical about how much ground the banks can regain.

“The problem is that brokers are pretty heavily embedded in the market, and, frankly, most borrowers still prefer them,” says S&P credit analyst Simon Geldenhuys. “As long as borrowers keep going to brokers, banks really don’t have a choice but to have a competitive broker offering and keep offering products through brokers.”

According to Jarden analyst Matthew Wilson, banks have effectively given away customer acquisition and loyalty by outsourcing distribution.

“Of course, they would like to be closer to the customer. But the industry must accept they created the third-party channel, and it’s likely that the genie stays out of the bottle.”

Any advice provided is general in nature and does not take into account your personal objectives, financial situation or needs. Before acting on this information, you should consider whether it is appropriate for you and seek independent advice if necessary. Please review the relevant product information before making any lending or investment decisions.

First Federal Pty Limited and First Federal Home Loan Pty Limited hold Australian Credit Licence 504317 and are regulated by ASIC and APRA.