NEWS & INSIGHTS

Credit eases for property developers despite industry pressure

Financing hurdles are coming down for developers, but pressure remains across the broader construction industry.

According to Stamford Capital’s latest Debt Capital Markets Survey, Australian lenders are fiercely competing for construction loans, with non-banks remaining the most aggressive. About 73% of survey respondents expect these lenders to increase their activity this year.

Even the major banks are now more open to residential projects after years of caution. Some 46% of respondents see them stepping up their loan books this year.

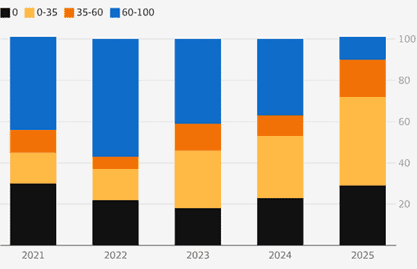

Figure: Share of pre-sales required by lenders for construction loans

Source: Stamford Capital Debt Capital Markets Survey

One major change in this type of lending is around pre-sale requirements, which force developers to secure a portion of apartment sales before their loan is approved. In 2024, a little over half of lenders required pre-sales of 35% or less. That figure has climbed to 71% this year, with almost one-third of lenders now not asking for pre-sales.

“A lot of the major banks are actually now accepting more deals,” says Stamford Capital Managing Director Peter O’Connor in a report.

“Banks were playing at the 60% to 70% level [of pre-sales required], but they are moving down to that 30% to 35% range. We’re seeing a lot of deals at that level, whereas historically that just wasn’t the case.”

At the same time, interest rates are falling, reducing costs and improving the feasibility of projects. Stamford’s data in fact shows that loan margins have dropped in the last 12 to 18 months.

“We’re currently seeing line fees and margins align at 200 basis points, whereas 12 months ago they were sitting at 240 and 250 respectively,” notes O’Connor.

Businesses under stress

This flexibility from lenders contrasts with the financial stress many construction businesses are experiencing. Rising material costs and project delays due to labour shortages and other issues have squeezed their cash flow.

According to a report from data and analytics provider Equifax, credit shopping by construction businesses has noticeably risen. In the June quarter of 2025, for example, more than half of enquiries from higher-risk entities – those with weak credit profiles – were from those shopping around for loans.

This is a worrying trend, says Brad Walters, Equifax’s Commercial General Manager. “It can be an indicator of stress and suggests that a business may be struggling to gain access to credit or be unable to secure favourable terms from lenders.”

Across the Australian economy, credit shopping among high-risk borrowers rose from 39% of enquiries in February this year to 49% the following month. But for the construction industry, the figure soared to 51%.

“That’s certainly a concerning trend that we’ve seen, that increase in the number of high-risk entities in construction credit shopping,” says Walters in a separate report. “So it’s possibly a signal that the lower credit quality end of the construction market is getting riskier.”

Industry strains show

The number of companies exiting the industry was also 3% higher in 2024–25 compared to a year earlier. In contrast, new business entries declined by 13%.

“Together, the subdued growth and increasing risk profile of Australian businesses across key segments could hinder efforts to strengthen economic growth and improve productivity,” says Walters.

Despite this, lenders are confident in the construction industry’s resilience.

“I definitely think that they’re looking to be more competitive, given the growth in their loan books is under pressure, and I also think that they believe in the strengths and the underlying fundamentals in the sector, especially with the rates trending downwards,” says O’Connor.

Any advice provided is general in nature and does not take into account your personal objectives, financial situation or needs. Before acting on this information, you should consider whether it is appropriate for you and seek independent advice if necessary. Please review the relevant product information before making any lending or investment decisions.

First Federal Pty Limited and First Federal Home Loan Pty Limited hold Australian Credit Licence 504317 and are regulated by ASIC and APRA.