NEWS & INSIGHTS

Rate cuts lift borrowing power but affordability slips further

With the cash rate now at 3.85% after two cuts in three months, attention is turning to what the reductions mean for Australia’s housing market. They are expected to lift buyer sentiment and boost housing activity in a market already constrained by low supply and persistently high prices.

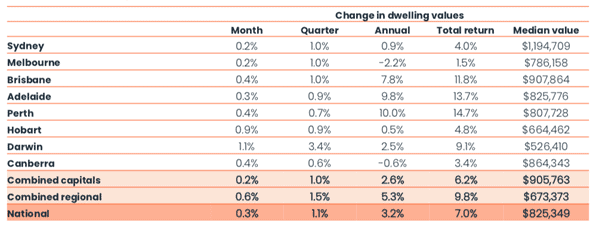

Property values have already started to pick up. Data from CoreLogic shows that the rate cut in February helped drive a third straight month of growth in April, when national housing values rose 0.3% and added $2,720 to the median home value.

Figure 1: Australian housing values as of 30 April 2025

Source: CoreLogic Hedonic Home Value Index, April 2025

Borrowing power grows

Financial comparison site Canstar estimates that the latest rate cut of 25 basis points has reduced repayments on a $600,000 home loan by roughly $91 a month.

With the prospect of lower repayments, many home buyers are reconsidering what they can afford and borrow now.

“There’s definitely people looking at ‘how much can I borrow?’ and saying ‘if we get another one or two rate cuts, what does that mean for my borrowing capacity?’” says Anthony Landahl, Managing Director at mortgage broker Equilibria Finance. “There’s definitely more confidence [among] people looking to maximise what they can borrow.”

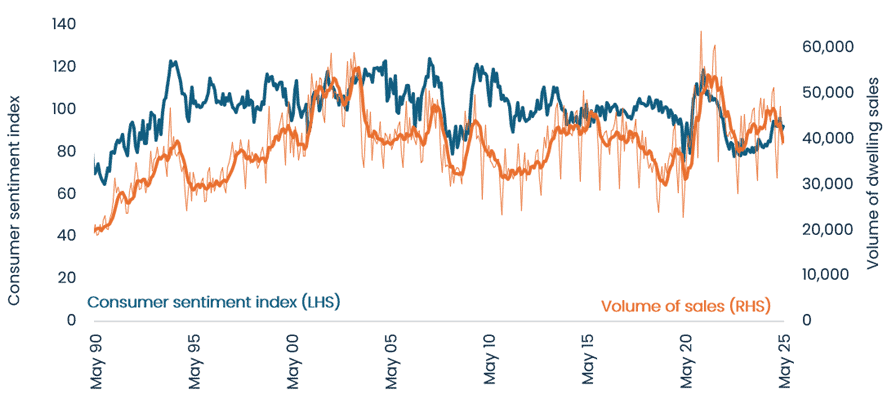

Figure 2: Consumer sentiment versus volume of housing sales

Source: CoreLogic, based on data from Westpac and Melbourne Institute

Mortgage brokers also report that buyer confidence is back.

“People are generally still borrowing the maximum they possibly can, especially now that confidence is somewhat back in the marketplace,” says Theo Chambers, Chief Executive of Shore Financial. “[At] the tail end of last year, when there was talk of more rate rises, people weren’t so confident.”

Growth faces headwinds

However, rate cuts often lead to more buyer competition, which typically drives up property prices when supply is limited.

“People think rate cuts will make housing more affordable, but they rarely do,” says Julian Finch, CEO of finance broker Finch Financial. “They drive demand, increase borrowing power and send prices up.”

According to Finch, the latest rate cut has already fuelled housing activity among investors, with many of them refinancing or growing their portfolios. This could drive short-term growth in housing turnover.

“Investors are in a stronger position to move quickly; they understand the game,” he says. “Meanwhile, first home buyers are trying to keep up while facing rising prices and intense competition for limited stock.”

He adds that another rate cut “is going to strap a rocket to it. Affordability is going to get worse, not better.”

Growth tempered by constraints

Indeed, rate cuts aren’t likely to drive runaway housing growth due to affordability and other issues, says CoreLogic’s Executive Research Director Tim Lawless.

“Several factors continue to constrain price growth, including stretched affordability, cautious lending practices, and the reality that despite 50 basis points of easing, interest rates remain in restrictive territory,” says Lawless.

He adds that any further upward pressure on prices would offset the benefits of improved loan serviceability.

Looking to the long term

With more rate reductions expected later this year, brokers urge buyers to think past their current borrowing power and consider long-term stability.

“If you’re buying, don’t just ask how much you can borrow, ask how much you can comfortably repay if rates shift back up in the next two or three years,” says Finch.

“If you already have a mortgage, now is the time to renegotiate, refinance or explore fixing part of your loan. Don’t wait for the next rate change to act.”

Any advice provided is general in nature and does not take into account your personal objectives, financial situation or needs. Before acting on this information, you should consider whether it is appropriate for you and seek independent advice if necessary. Please review the relevant product information before making any lending or investment decisions.

First Federal Pty Limited and First Federal Home Loan Pty Limited hold Australian Credit Licence 504317 and are regulated by ASIC and APRA.